does shopify provide tax documents

If you need information about 1099-K forms and you use Shopify Payments then refer to Tax reporting. Schedule C if you are a sole proprietor and have income or losses to report.

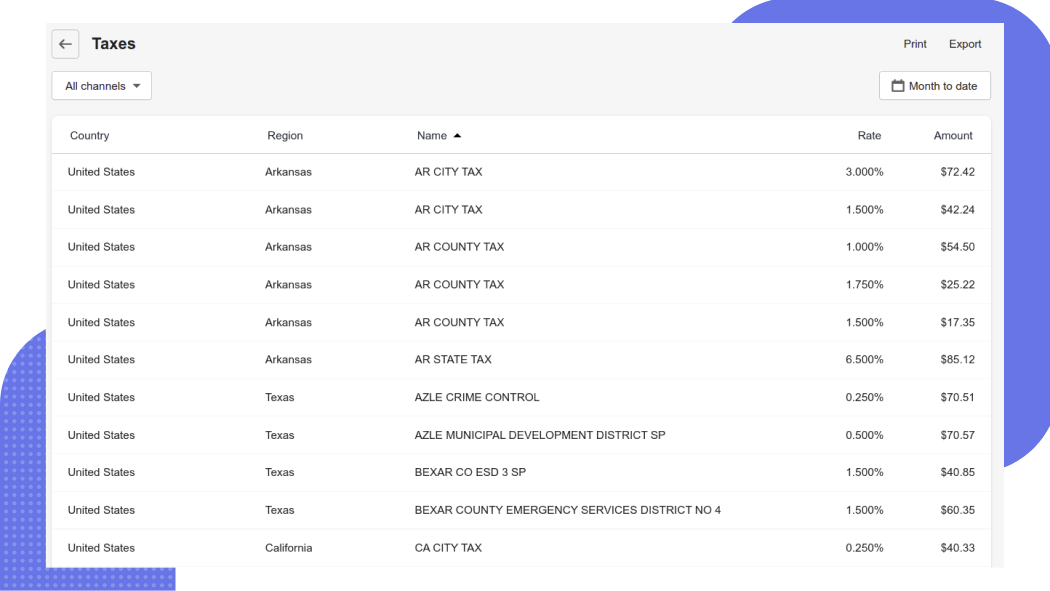

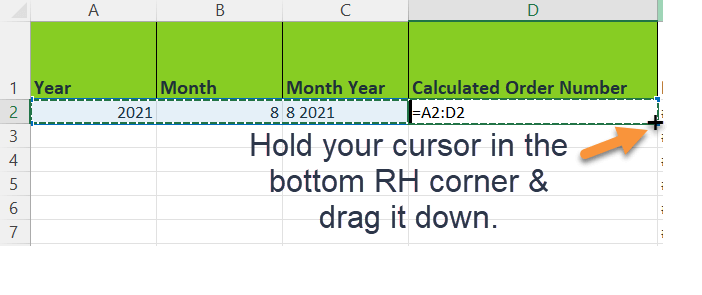

Importing Tax Lines To Shopify Highview Apps

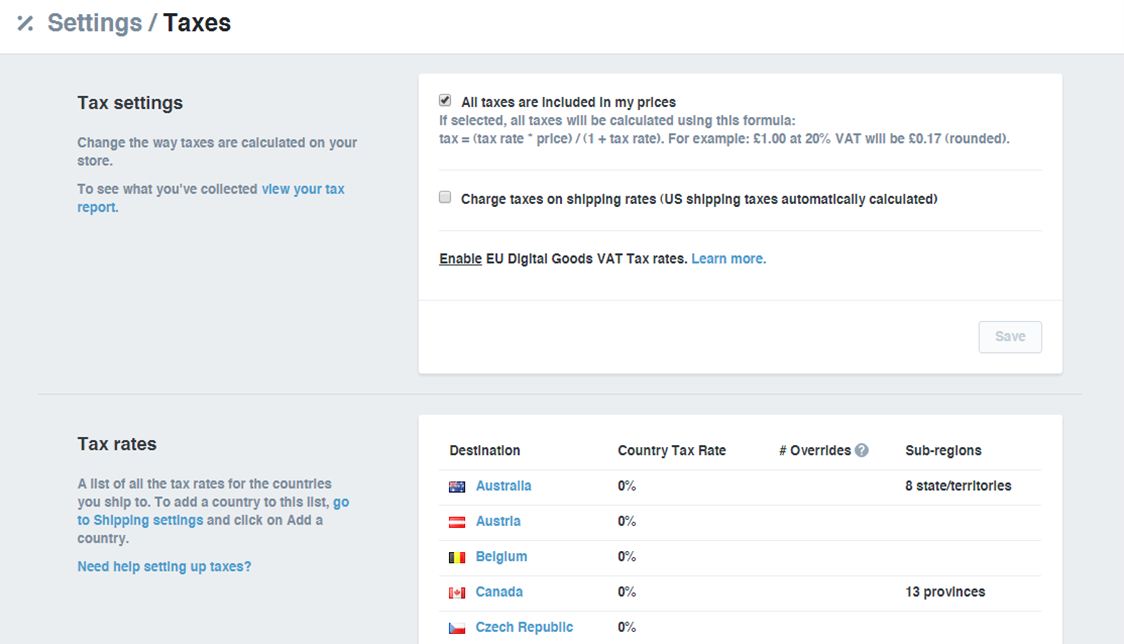

Click Add tax override if you need to add a special case to your tax collection.

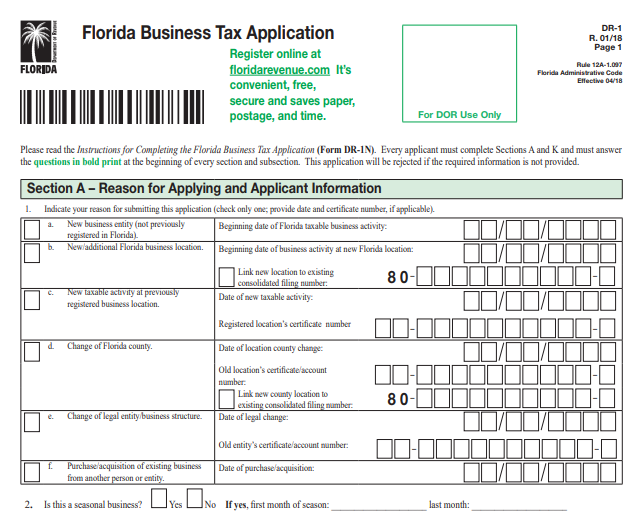

. You might need to register your business with your local or federal tax authority to handle your. As an ecommerce platform Shopify is required to report sales tax to the IRS on behalf of its merchants. Shopify doesnt file or remit your sales taxes for you.

Therefore Shopify doesnt fall under marketplace facilitator laws that require stores like Amazon or Ebay to collect and remit sales tax for its. Shopify doesnt file or remit your sales taxes for you. If the new location isnt shown then background the app by pressing the home button on your device.

Tap the small. But if not you can come back to this later. A drop-down menu will appear then select Documents.

March 15 is the deadline to file individual and partnership tax returns. Click Save Set up Rest of. Under Payout schedule in the Payout details section check or uncheck Enable notifications.

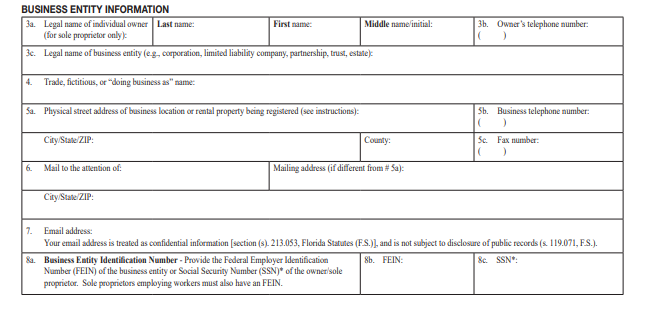

Youre a merchant who sells a 30 t-shirt in a state where you. In order to do so Shopify collects the necessary information from. The earlier deadline gives partners a chance to receive Schedule K-1s before the personal tax return due.

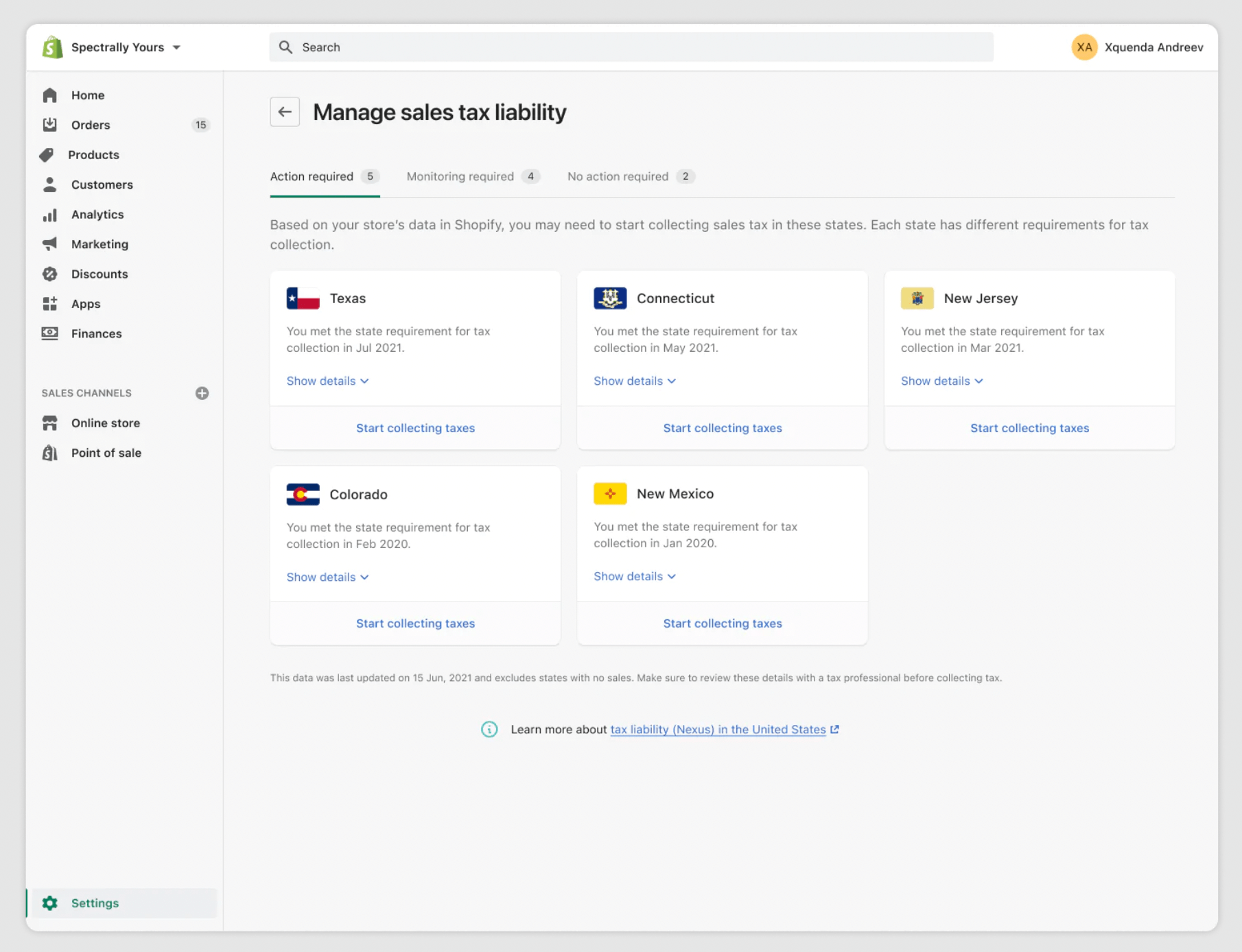

Choose your store address. Determine your tax liability. Tap and select Documents.

If you have a tax number you can enter it. Set up fraud prevention. 1099-K issued by Shopify for merchants turning over 20000 a.

Working with a professional Shopify tax accountant is the safest way to take advantage of the benefits from. Shopify doesnt file or remit your sales taxes for you. Does Shopify provide tax documents.

The 1099-K form is submitted by Shopify to the IRS if you are using Shopify Payments and meet the following requirements. Does Shopify collect and remit sales tax. The platform provides sellers with handy Shopify tax documents that show you how much the site has collected in taxes on your behalf for each of your sales.

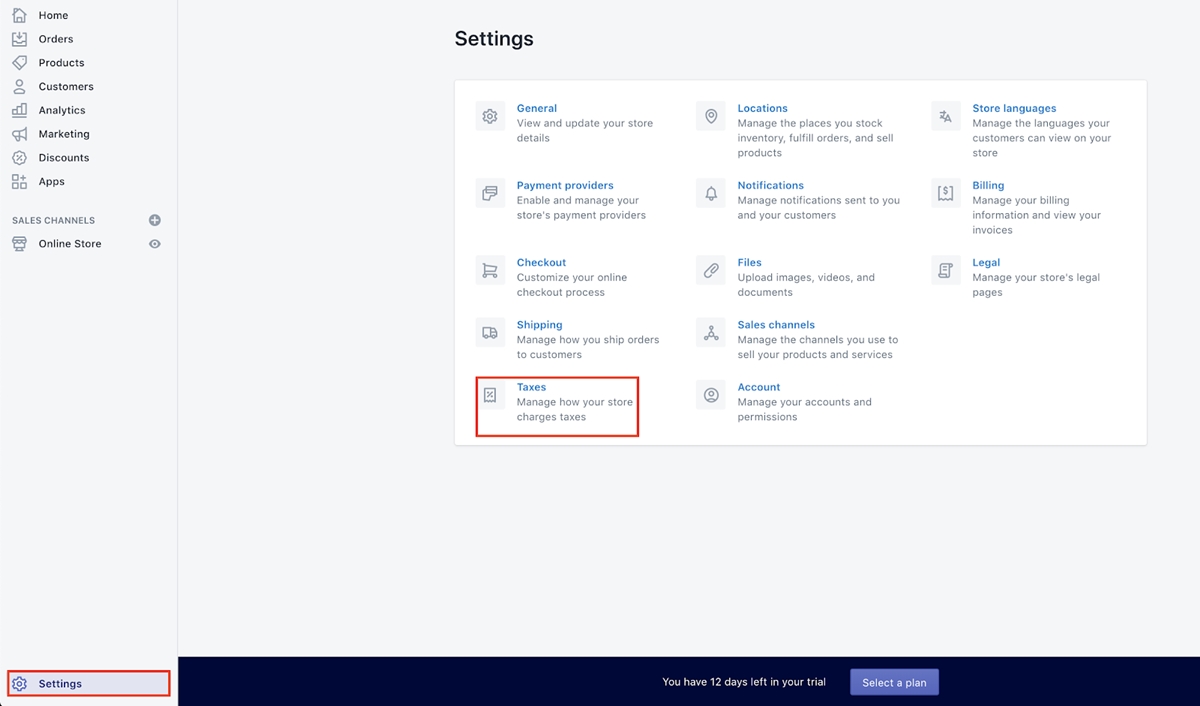

In the Shopify Payments section click Manage. Does Shopify provide tax documents. Before you set up your US taxes you need to determine.

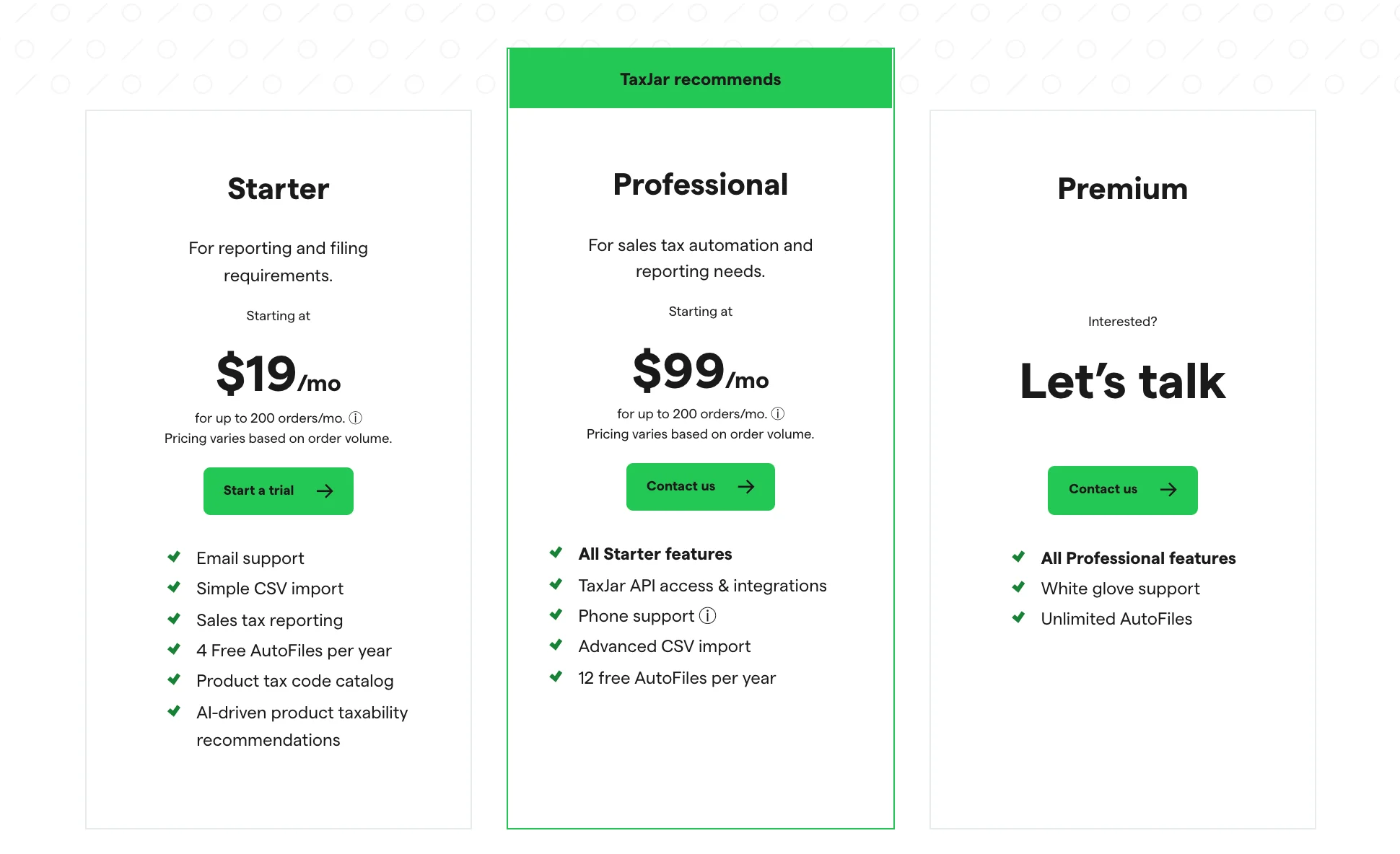

For all other merchants the transaction fee is 035 per order where sales tax is collected up to a maximum of 099 per order. Country regional we got. You might need to register your business with your local or federal tax authority to.

Button on top of your payouts information. Heres a step-by-step guide on setting up taxes for your Shopify store. Form 1040 for income tax returns.

Tax planning helps businesses reduce their tax liability in a legal way. For calendar years prior to 2022. Add your new store locationAssign your Shopify POS device to the new location.

Does Shopify provide tax documents. You must select your store address to set up taxes for your Shopify store. You might need to register your business with your local or federal tax authority to.

How To Charge Shopify Sales Tax On Your Store Nov 2022

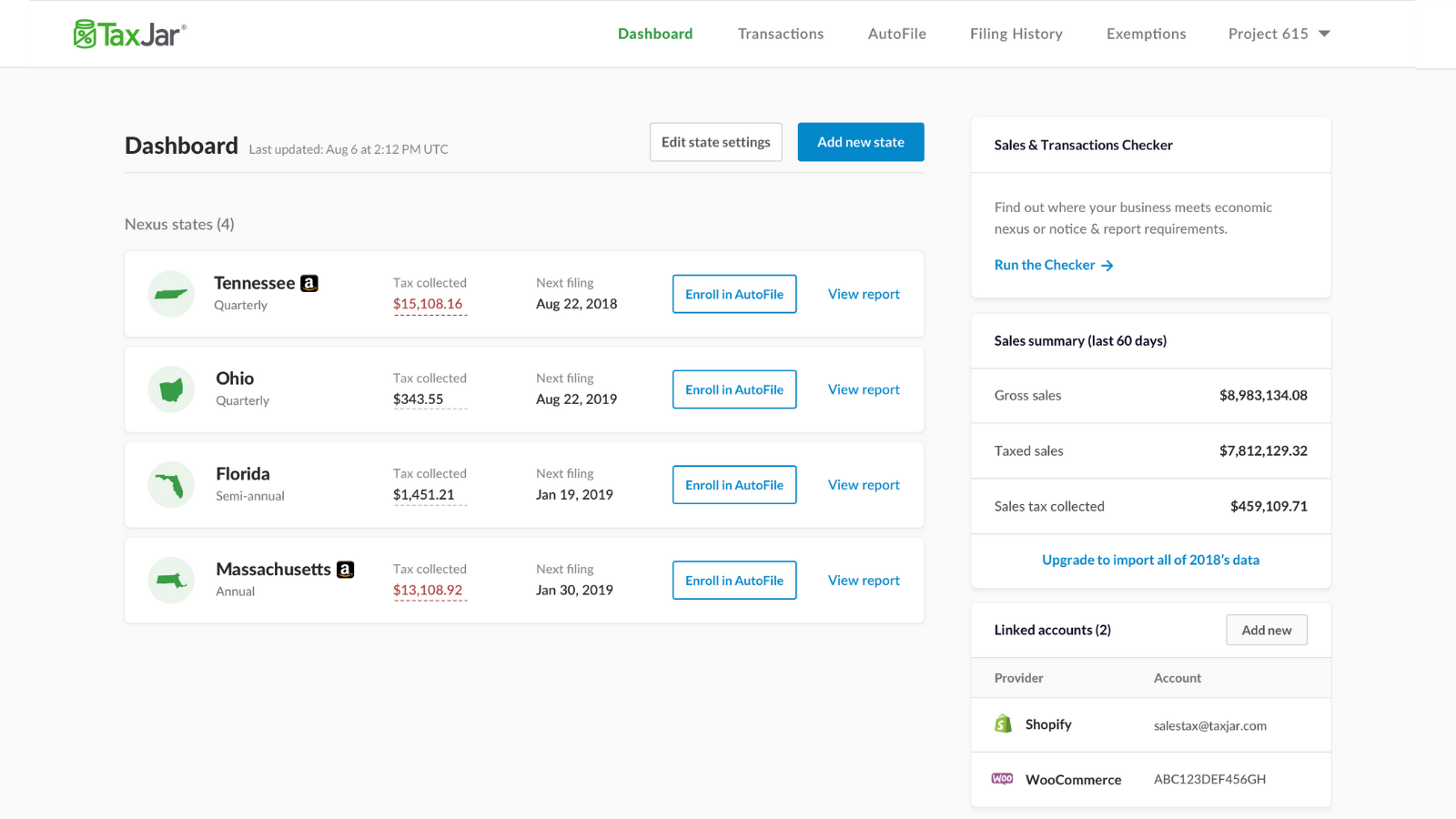

Everything You Need To Know About Shopify Sales Tax In 2019 Sellbrite

Usa Etsy Shopify Bookkeeping Spreadsheet Automated From Csv Etsy

The Complete Guide To Filing Your Shopify 1099 Taxes In 2022

Sales Tax Guide For Shopify Sellers

Everything You Need To Know About Shopify Sales Tax In 2019 Sellbrite

Everything You Need To Know About Shopify Sales Tax In 2019 Sellbrite

Everything You Need To Know About Shopify Taxes Taxhack Accounting

Shopify Sales Tax Report Step By Step Guide Self Service Bi Reporting Platform

The Complete Guide To Filing Your Shopify 1099 Taxes In 2022

How To Set Up Shopify Taxes For Dropshipping

Shopify Sales Tax Report A Complete Guide

Everything You Need To Know About Shopify Sales Tax In 2019 Sellbrite

Shopify Sales Tax The Ultimate Guide In 2022

Everything You Need To Know About Shopify Sales Tax In 2019 Sellbrite

Shopify Sales Tax Report How To Find Understand It

Everything You Need To Know About Shopify Sales Tax In 2019 Sellbrite