tax loss harvesting canada

If you sold at a loss on or before that date. Tax-loss selling also known as tax-loss harvesting is a strategy available to investors who have investments that are trading below their original cost in non-registered accounts.

Tax Loss Harvesting At Work A Wealthsimple Case Study Boomer Echo

How Much Can You Save with Tax-Loss Harvesting.

. In Canada the last day in 2021 for tax-loss selling on the Toronto Stock Exchange was December 29 2021. Mary is in the 24 tax bracket. You need 50000 to get tax loss harvesting A main benefit of robo-advisors is their tax-loss harvesting abilities.

This is where tax-loss harvesting comes into play. Dec 14 2020 Tax-loss harvesting occurs when you sell an investment that has dropped below its original purchase price triggering a capital loss. What that means is on a capital gain of 20000 for example 10000 would become taxable income.

To be clear there is no benefit to tax-loss selling in your TFSA or RRSP. The amount of money that you can save with tax loss harvesting in Canada depends on your tax bracket. This entire conversation only applies to your non-registered accounts where deferring capital gains.

Instead their broker does it automatically. You or a person affiliated with you buys or has a right to buy the same or identical property called substituted property during the period starting 30 calendar days before the sale and ending 30 calendar days after the sale. The amount of money that you can save with tax loss harvesting in Canada depends on your tax bracket.

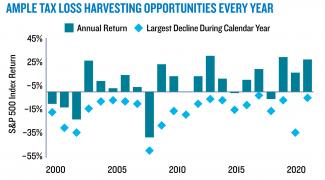

One useful thing you can do with your portfolio during market declines is check your taxable accounts for opportunities to tax-loss harvest. Tax-loss harvesting is the timely selling of securities at a loss in order to offset the amount of capital gains tax due on the sale of other securities at a. What Is Tax-Loss Harvesting.

Tax loss harvesting also known as tax loss selling is the practice of selling shares or units held in a non-registered account that have dropped in value to the point that a capital loss can be claimed eg. The bottom line on tax loss harvesting. If you dont know if tax-loss harvesting is right for you just send us an email or give us a call and we can help you figure it out.

Tax-loss harvesting is a practice that takes advantage of the rules that let you use capital losses to offset other forms of taxable income. Theres something called the superficial loss rule in. You can turn it on and off in the settings tab of your dashboard when you sign into your account.

However in general you can expect to save around 30 of the amount of the loss. Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to offset capital gains taxes elsewhere. So if you lose 1000 on investment you could save around 300 on your taxes.

One more small question. Automatic rebalancing You dont have to watch your portfolio like a hawk. Getting started with tax-loss harvesting.

There are however tax-loss harvesting strategies that allow you to maintain exposure to a particular stock or sector while still realizing a capital loss. With Charles Schwab Intelligent Portfolios you only get this service if you have at least 50000 invested. Canadians are fortunate to have so many tax-sheltered investment options including RRSPs RESPs and TFSAs.

You can then use these losses to offset your taxable capital gains. Lets go over how it all works. The concept behind tax loss harvesting entails that future capital gains can be taxed lower or in part because of capital losses incurred in the present.

Tax-loss harvesting does not apply to IRAs or other tax-sheltered accounts To explain what tax-loss harvesting is lets look at an example. Tax-loss harvesting involves selling the losing securities in order to generate a capital loss. An investor can then use this capital loss to offset a capital gain somewhere else in the portfolio.

The best way to pay less tax on your investments is by maximizing your available contribution room in these registered accounts. Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada. Harvesting losses as they occur may help to.

You have until two trading days before the end of the year to sell assets to qualify for tax-loss harvesting however it is recommended that investors do this quarterly. Once youve done that tax loss harvesting is a great way to find additional tax savings inside a. A superficial loss can occur when you dispose of capital property for a loss and both of the following conditions are met.

Most people dont perform tax loss harvesting manually. Going back to our example after the investor sells their bank shares at a loss they could then purchase a Canadian bank stock ETF or a Canadian equity mutual fund with a large exposure to the Financials sector. The strategy offers a silver lining allowing investors to make use of losses by partially diminishing or negating taxes owed on gains realized.

These investments could be stocks bonds. Tax loss harvesting also known as tax loss selling is the practice of selling shares or units held in a non-registered account that have dropped in value to the point that a capital loss can. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins.

An investor with a marginal tax rate of 40 purchased 100 shares of TELUS stock at 50 per share at the beginning of the. While the process is automated there are still some areas to look out for such as the wash sale. We make tax-loss harvesting available for all Canadian Wealthsimple Black clients.

Tax-loss selling also known as tax-loss harvesting is a technique for realizing or crystallizing capital losses in your non-registered accounts so they can be used to offset taxable capital gains. Tax loss harvesting is an additional method of tax management in regards to investment planning. In Canada the income inclusion rate for capital gains is 50 percent which then gets taxed at an individuals marginal tax rate.

What Is Tax Loss Harvesting. Mar 19 2020 Tax loss harvesting tends to happen near the end of the year although there is no specific requirement. At its most basic tax-loss harvesting involves intentionally selling poorly performing investments for a loss and reinvesting the proceeds back into the market.

Tax loss harvesting is a type of portfolio rebalancing for tax efficiency purposes. The capital loss can be used to offset capital gains either in the current year or in the previous three tax years or they can be carried forward to any future year. But again not everyone should do it.

What Is Tax Loss Harvesting Ticker Tape

How To Use Tax Loss Harvesting To Boost Your Portfolio

Turning Losses Into Tax Advantages

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Partners Physician Finance Basics

Using Exchange Traded Funds In Tax Loss Planning

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

What Is Tax Loss Harvesting Ticker Tape

I Get Free Tax Loss Harvesting Awesome Wait What Is That Wealthsimple

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

Turning Losses Into Tax Advantages

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

Volatile Markets Raise Tax Loss Harvesting Opportunities

The So Wealth Management Group Year End Tax Loss Harvesting

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management